Carbon Tax Implementation and Its Impact on Industry

Discover how carbon tax impacts industry and how Enge Energy’s renewable solutions help businesses achieve cost savings and carbon-neutral production.

Carbon Tax Implementation and Its Impact on Industry

The increasingly visible effects of climate change are pushing governments and international organizations to take decisive action to reduce carbon emissions. Among the most discussed and implemented methods is the carbon tax.

The carbon tax not only delivers environmental benefits but also directly impacts industrial production processes, costs, and competitiveness. In this article, we will explore carbon tax implementation, its effects on industry, and how Enge Energy’s solutions can help businesses gain an advantage during this transition.

What Is a Carbon Tax?

A carbon tax is an environmental tax imposed on carbon dioxide emissions resulting from the use of fossil fuels. Its main goals are to:

-

Reduce fossil fuel consumption

-

Encourage investments in renewable energy

-

Reflect environmental costs in industrial operations

-

Create awareness by pricing carbon emissions

Carbon Tax on a Global Scale

-

Sweden: Has implemented a carbon tax since 1991 and achieved significant reductions in per capita emissions.

-

Canada: Made carbon tax mandatory across all provinces.

-

EU Countries: Apply carbon pricing through the Emissions Trading System (ETS).

In Turkey, the European Green Deal and export-related pressures are rapidly bringing carbon pricing mechanisms to the agenda.

The Impact of Carbon Tax on Industry

The carbon tax presents both opportunities and risks for industrial enterprises.

1. Rising Costs

Factories using fossil fuels face increased production costs due to higher carbon taxes.

2. Competitiveness

Companies investing in renewable energy gain an edge in competition by producing with lower carbon intensity.

3. Exports and the Green Deal

For companies exporting to the EU, the Carbon Border Adjustment Mechanism (CBAM) is of critical importance. To avoid carbon tax payments, low-carbon production is a must.

4. Investment and Innovation

Carbon tax encourages companies to invest in energy efficiency projects and renewable energy technologies.

Solutions Against Carbon Tax

To mitigate the negative effects of carbon taxation, companies can adopt the following strategies:

-

Investments in energy efficiency

-

Solar energy applications (rooftop PV, solar thermal walls, collector systems)

-

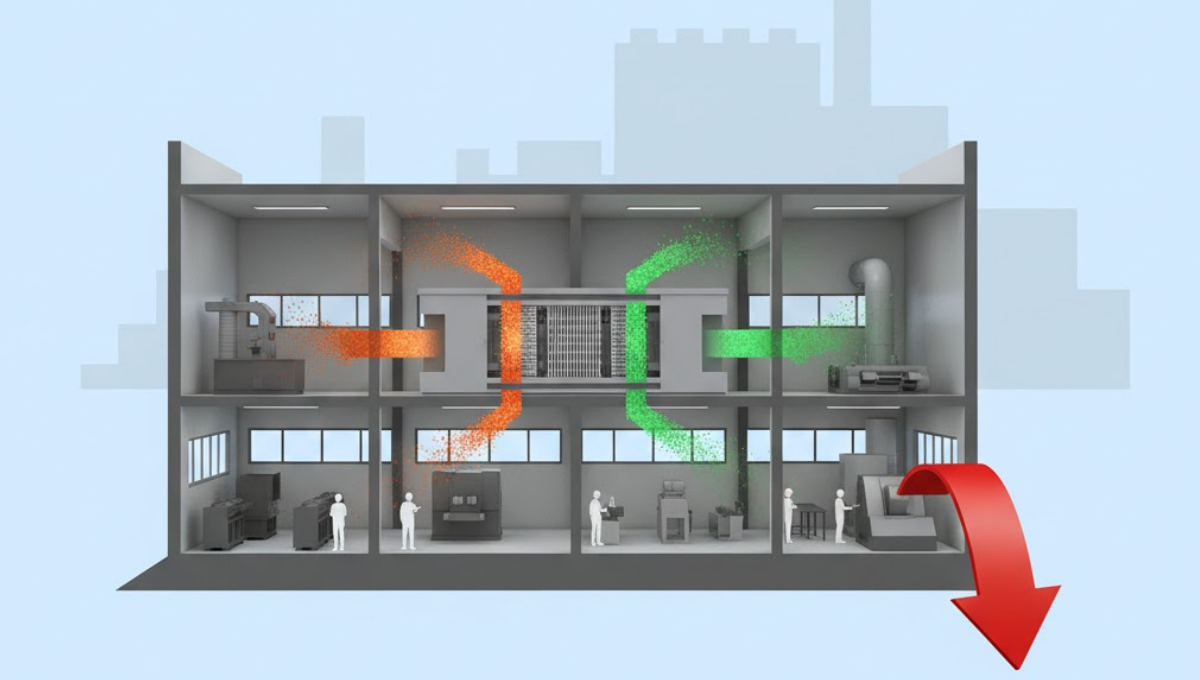

Waste heat recovery

-

Carbon footprint measurement and reporting

Enge Energy’s Solutions

Enge Energy provides innovative solutions to help industrial facilities adapt to carbon tax regulations and achieve carbon-neutral production goals:

-

Engesolarbox® Technology: Solar-based electricity and heat production for factories.

-

Solar Thermal Wall: An aesthetic and functional solution for industrial façades.

-

Industrial Solar Collectors: Renewable alternatives for hot water and steam generation.

-

Energy Consultancy: Carbon footprint calculation, efficiency reporting, and green transition projects.

With these solutions, factories can reduce energy costs while also minimizing the financial burden of carbon taxation.

The Future of Carbon Tax

As Turkey advances its carbon market preparations, carbon taxation is expected to expand in the near future. This will particularly affect industrial enterprises focused on exports.

Therefore, it is vital for companies to define their carbon management strategies today.

The carbon tax will drive significant changes in industrial production and steer companies toward low-carbon operations. Businesses that adapt to this process will not only benefit from cost savings but also gain advantages in terms of brand reputation and sustainability.

Enge Energy, with innovative solutions such as Engesolarbox®, supports companies in preparing for carbon taxation and transitioning to low-carbon production.

Similar Content